What Does It Cost To Register An S Corp In Oregon

Factors to Consider Before Starting an S Corp

Earlier forming an S corp, you have to consider the following factors:

- Is an S corporation the all-time strategy for your business organisation?

- Due south corporation restrictions

- Why an LLC is the best structure for the S corp tax status

- Are S corp tax advantages right for you?

Is an S Corporation the Best Strategy for Your Business organization?

South Corporation Restrictions

S corps have several restrictions, such as being limited to ane class of stock and 100 shareholders. Read our What Is an Southward Corporation guide for full details.

Why an LLC Is the All-time Structure for the S Corp Taxation Status

Equally entrepreneurs, we believe that starting an LLC is the best mode for forming an S corporation considering any advantages of forming a corporation are negated by South corp restrictions. LLCs are as well easier to maintain than corporations.

Are S Corp Revenue enhancement Advantages Correct for You?

You need to know if the S corp tax condition versus a default LLC revenue enhancement condition will be better for your business. To fully understand the tax advantages of an South corp, read our LLC vs. South corp guide.

How to Course an South Corp

There are ii primary means to start an S corp:

- By forming an LLC and electing S corp revenue enhancement condition from the IRS when yous request your employee identification number (EIN)

- By forming a corporation and electing S corp status from the IRS

Nosotros recommend not starting a corporation with the South corp tax status considering the S corp negates all of the benefits of a corporation.

Recommended: If yous accept an existing LLC, visit our How to Catechumen an LLC to Southward Corp guide.

Steps for Forming an LLC and Electing Due south Corp Status in Oregon

Starting an Oregon LLC and electing Southward corp taxation status is easy. You tin can use our guides to start an LLC with the Southward corp condition yourself, or yous can hire a service provider like ZenBusiness to practice it for you.

There are five bones steps to start an LLC and elect S corp status:

Footstep 1: Name Your LLC

Step ii: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Stride 5: Get an EIN and File Form 2553 to Elect S Corp Taxation Status

Step 1: Proper name Your LLC

Choosing a company name is the outset and most important step in starting your LLC in Oregon.

Exist certain to cull a proper name that complies with Oregon naming requirements and is easily searchable past potential clients.

1. Follow the naming guidelines for an Oregon LLC:

- Your proper name must include the phrase "express liability company" or one of its abbreviations (LLC or L.Fifty.C.).

- Your proper name cannot include the following:

- cooperative, corporation, corp., incorporated, Inc., limited partnership, L.P., LP, Ltd., limited liability partnership, L.L.P., and LLP.

- Your proper noun may include the following special characters:

- asterisk (*); "at" sign (@); backslash (/); left brace ( { ); right caryatid ( } ); caret (^); dollar sign ($); "equal to" sign (=); "greater than" sign (>); "less than" sign (<); number sign (#); percentage sign (%); plus sign (+); tilde (~); and underscore (_).

- Your name may include the post-obit punctuation:

- apostrophe ( ' ); left bracket ([ ); right bracket( ]); colon (:); comma (,); dash or hyphen (-); exclamation indicate (!); left parenthesis (( ); right parenthesis ( ) ); flow (.); question mark (? ); unmarried quote mark (" ); double quote marker ( " " ); semicolon (;); and slash ( / ).

- Your proper noun cannot imply in any way that the business is an agency of the state or any of its political subdivisions without approving.

- Certain restricted words (eastward.1000. Banking concern, Attorney, University) may require additional paperwork and a licensed individual to be office of your LLC.

- Your name must exist distinguishable from any existing business in the state. This includes Oregon reserved names.

- You can read general business naming rules on the Secretary of Land's website.

2. Is the proper name available in Oregon? You tin can use the business proper noun search on the Oregon Secretary of State website to see if your desired LLC name is available.

3. Is the URL available?We recommend checking to encounter if your concern name is available as a web domain. Even if you lot don't plan to create a business website today, you may want to purchase the URL in order to prevent others from acquiring it.

Notice a Domain Now

Stride 2: Cull Your Oregon Registered Agent

You must elect a registered amanuensis for your Oregon LLC.

An LLC registered agent will take legal documents and taxation notices on your LLC's behalf. You volition list your registered agent when you file your LLC's Articles of Arrangement.

Many business owners cull to hire a registered agent service. Many of these services will form your LLC for a small fee and include the kickoff year of registered agent services for free.

Recommended: ZenBusiness provides the first yr of registered agent service free with Southward corp germination.

Step 3: File the Oregon LLC Manufactures of Organization

The Oregon Articles of Organization is used to officially annals an LLC.

OPTION 1: File Online With the Oregon Business organisation Registry

File Online

- OR -

Pick two: File by Mail

Download Form

State Filing Cost: $100, payable to the Corporation Division (Nonrefundable)

Mailing Address:

Secretarial assistant of State, Corporation Sectionalisation

255 Capitol St. NE

Suite 151

Salem, OR 97310

Footstep four: Create an LLC Operating Agreement

An LLC operating agreement is a legal document that outlines the buying and member duties of your LLC.

For more information, read our Oregon LLC Operating Understanding guide.

Our operating agreement tool is a gratuitous resource for business owners.

Step 5: Get an EIN and Complete Form 2553 on the IRS Website

An EIN is a number that is used by the U.s.a. Internal Revenue Service (IRS) to identify and revenue enhancement businesses. It is essentially a Social Security number for a business.

EINs are free when you lot utilise directly with the IRS.

Elect S Corp Tax Status

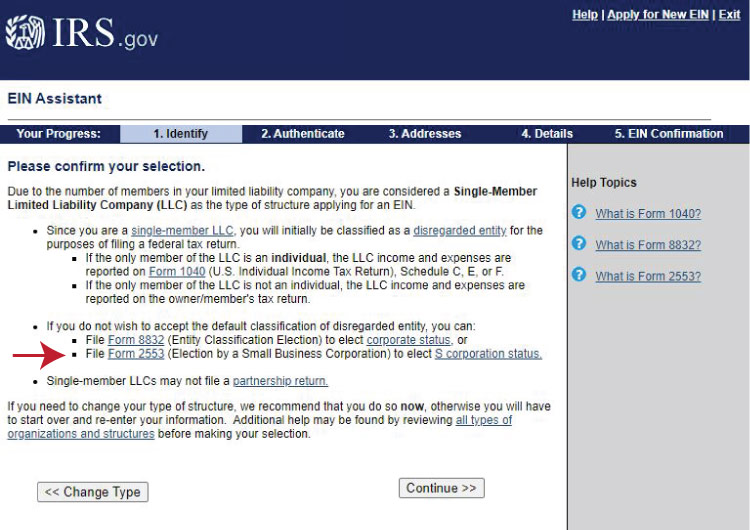

During the online EIN application, the IRS volition provide a link to Form 2553, the Election By a Pocket-size Business form.

Visit our Form 2553 Instructions guide for detailed assist with completing the form.

This is the course to elect S corp tax status for your LLC:

Rent a service provider similar ZenBusiness to form an LLC and elect S corp condition for y'all.

Start an S Corp FAQ

What is an Southward corp?

An Due south corporation (S corp) is a tax designation for which an LLC or a corporation can apply.

Is an South corp an LLC?

No. An S corp is a tax designation for which an LLC or a corporation can elect.

How do you lot class an South corp?

You lot can form an S corp by filing Class 2553 with the Internal Acquirement Service (IRS).

What are the requirements for an S corp?

Due south corps must encounter four requirements:

- They can have no more than than 100 shareholders.

- All shareholders must be private individuals (not other business entities).

- Shareholders cannot exist nonresident aliens.

- The business concern may only effect ane course of stock-this means all members must have the aforementioned distribution corporeality.

What are the benefits of an South corp?

Owners of S corps are considered employees of their company and can save thousands of dollars on self-employment taxes as a issue.

Are taxes for LLCs and Southward corps the same?

No. The default taxes for an LLC and taxes for an S corp are not the aforementioned.

With an S corp, owners pay personal income tax and cocky-employment taxation on a predetermined salary. They may so withdraw whatever remaining profits from the business as a "distribution," which isn't subject to self-employment tax.

With an LLC, all visitor profits pass through to the owners' personal tax returns, and then the owners must pay personal income tax and cocky-employment revenue enhancement on the entire amount.

Both LLCs and South corps do good from a provision in the Taxation Cuts and Jobs Human action of 2017 that allows qualifying owners of laissez passer-through entities to deduct 20% of qualified business income (QBI) from their tax returns. However, for S corps, the deduction doesn't apply to profits paid out equally wages.

What is a reasonable salary for an South corp?

Dissimilar the default LLC concern structure, in which owners must pay self-employment tax on all of the company's profits, owners of South corps are considered employees of the business and only have to pay self-employment tax on a salary they receive. Any other money they take from the company'south profits in the grade of disbursements isn't subject to cocky-employment revenue enhancement.

Due south corp owners are required to earn a "reasonable" bacon, which basically ways a fair market place rate based on the private's qualifications too as their duties and responsibilities at the company. The purpose of this requirement is to preclude Southward corp owners from paying themselves an artificially low bacon in order to pay less self-employment tax.

What is a distribution?

A distribution is a dividend that a shareholder/owner tin can take from the concern profits that remain later on a visitor pays all of its employee salaries. Shareholders must pay personal income tax on distributions, but distributions aren't subject to cocky-employment tax.

What is laissez passer-through taxation?

Laissez passer-through taxation is a arrangement of tax that generally applies to sole proprietorships, partnerships, LLCs, and Due south corps. In this arrangement, the profits or losses of the business organisation are not taxed at the business level. Instead, they pass through to the owners' personal tax returns and are taxed at each owners' personal income tax rate.

What is the South corp revenue enhancement rate?

At that place'southward no corporate tax charge per unit for Southward corps. Instead, owners of South corps pay personal income tax on the company's profits. This charge per unit depends on each owner's personal income tax bracket.

Tin I withal use my DBA name if I elect to exist an S corp?

LLCs and corporations that operate under a "doing business organization equally" (DBA) proper noun can choose the S corp election.

Source: https://howtostartanllc.com/start-an-s-corp/oregon-s-corp

Posted by: cordesciediand.blogspot.com

0 Response to "What Does It Cost To Register An S Corp In Oregon"

Post a Comment